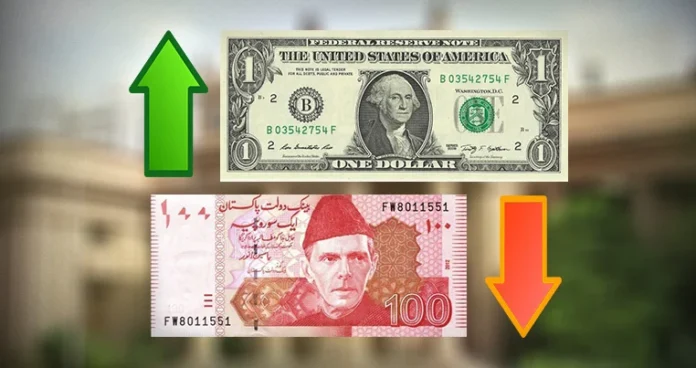

Pakistani rupee saw a great fall against the US dollar since May 2021 after being declared as the best a few months ago. It closed the trade on Monday, September 6 at 167.63 PKR which is more than 10% higher than 151.17 PKR in May. Many market experts, currency dealers, and other analysts were concerned about this currency devaluation and stated various reasons.

Currency Devaluation by The State Bank of Pakistan

Most of the criticism fell upon the State Bank of Pakistan (SBP) for making wrongful predictions. According to the reports, SBP mentioned that there will be an appreciation in the dollar due to account deficit but failed to inform about the limit of rupee deterioration or the point of its stability. Despite the low turnout in the currency market, dealers were also unable to find the endpoint where currency could become stable.

SBP had been following a flexible exchange-rate system in which supply and demand determined the value of the local currency against others. It meant that SBP let the currency devaluate and find its “real value” just like it did in 2018. SBP believed that the rupee was overvalued and did not interfere in any way despite the calls for making upward adjustments, restricting luxury imports, and preventing imported inflation and further currency devaluation.

On the contrary, SBP did intervene when the USD was depreciating in March 2021. Reportedly, USD was standing at 155PKR and the market was expecting a further fall in the greenback. SBP quickly purchased the greenback to support the dollar and increase its value by 1 PKR against the Pakistani rupee. Currency dealers were alarmed as to why the central bank would weaken its own country’s currency when it can keep it artificially high at any time.

Unable to Use Foreign Exchange Reserves

The Pakistani rupee was appreciating when International Monetary Fund (IMF) suspended the loan program due to the COVID-19 outbreak in February 2020. The local currency performed relatively better with support from various other factors when the demand for the US dollar decreased among the public. The foreign reserve was still expanding as Pakistan also received funds under the IMF’s Special Drawing Rights (SDR) program for supporting poor countries. Reportedly, the foreign exchange reserves stood at 22.25 billion USD but still, it did not save the PKR from currency devaluation. The central bank had an opportunity to intervene as the demand for dollar was lower in many segments of society during the COVID situation.

Former general secretary of Exchange Companies Association of Pakistan (ECAP), Zafar Paracha explained that people normally used dollars for traveling or paying education fees abroad. Since all of that was closed during COVID, the dollar had little use in Pakistan. Other than that, the remittances from overseas Pakistanis played a major role in increasing the value of the rupee during those times. The suspension of flights led people to use the financial sector in sending remittances instead of in person. They also invested in various assets through Roshan Digital Account (RDA) which kept the rupee surging and foreign reserve increasing.

If the SBP did not make the rupee dependent on the market forces and used foreign reserves for open market operations and expanded cash in the financial sector, it would have valued the rupee higher and made USD a little bit cheaper.

High Demand for Dollar by Importers

On the other hand, there is a high demand for USD by the traders to pay for imports. Due to exports being pushed after post-COVID economic recovery, excessive imports for raw materials and finished goods have caused inflation in the country.

Traders tend to book dollars early for making import payments in the future, which comes at a higher premium than usual. Moreover, aspiring capitalists import heavy-duty machinery for setting up their new businesses or expand existing ones. As a result, it causes appreciation for the dollar and currency devaluation for the PKR.

Previously, Pakistan’s exports were performing better than imports which is why the rupee was surging. According to recent data, the imports were two times more than exports. The trade deficit for August 2021 was 4.06 billion USD, which was 133% higher than last year’s 1.74.

Afghanistan Situation

Market dealers also cited the unstable situation of security and politics related to current affairs in Afghanistan. As the Taliban continued their takeover, several foreign accounts of the Afghan government were closed including those in Pakistan.

Also, when the US military was there, Pakistan enjoyed a dollar influx of 5 to 7 million USD on daily basis, which has now stopped. Moreover, Afghans living in Pakistan sent remittances back home up to 2 million USD that contributed to PKR’s decline.